Displaying items by tag: Banking

Datadog Unveils Plans for Data Centre in Australia

Local data centre to create sovereign data storage and processing capacity for Datadog’s customers and partners, helping meet local privacy and security requirements and preferences

Backbase and MeaWallet Partner To Transform Digital Payment Security in Australia and New Zealand

COMPANY NEWS: Banks and fintechs set to deliver secure, frictionless digital payment experiences through advanced tokenisation technology

The Business Case for Video Analytics: Understanding the Real ROI

GUEST OPINION: For security professionals who may be hesitant to invest in video analytics, now's the time to reconsider. In a newly released Omdia report commissioned by BriefCam (now Milestone Systems), the research firm uncovered a compelling story: more than 85% of the organisations surveyed that use video analytics achieve a return on investment within just one year. The study, which surveyed 140 end users across multiple industries, demonstrates that security technology is no longer just for security — it's a cross-organisational tool that delivers measurable business value far beyond traditional safety applications.

StarHub and Nokia partner on network APIs to ‘drive 5G and 4G application development’ in enterprise verticals

- Working closely with developers, the two companies are targeting new applications for enterprises in banking, finance, ports, online streaming, and the public sector.

- StarHub’s 5G and 4G networks will connect to Nokia’s Network as Code platform with developer portal to give developers a seamless pathway for creating new applications.

Singaporean telecommunications conglomerate Starhub, with over 2 million subscribers, and Nokia are partnering on network APIs to support StarHub’s mission to create new revenue opportunities for its customers and monetise its network assets.

Six bold predictions to drive $1 trillion+ industry transformation in 2025

GUEST OPINION: Future-focused C-suite banking forecasts: major shifts in customer experience, revenue models, and tech infrastructure

Levelling the playing field: Why competition in Australia needs a reset

GUEST OPINION: Throughout 2024, some of Australia’s biggest companies have been in the spotlight due to anti-competitive behaviour. Coles and Woolworths were called out for a sneaky pricing strategy. And in the aviation industry, Qantas is being urged to sell Jetstar in order to create a fairer and more accessible aviation industry.

Entrust Helps Fight Fraud at Account Opening and Every Day with New Consumer Banking Platform

Solution integrates leading AI-driven identity verification technology with physical and digital card issuance capabilities to reduce fraud at account opening and provide continuous account protection

How Australian banks can improve their physical security posture in 2025

GUEST OPINION: Deploying latest generation monitoring technology will make the challenge of securing branches considerably simpler.

Backbase Unveils Intelligence Fabric To Unlock AI-Productivity Gains For Banks

COMPANY NEWS:

- The expansion of the Engagement Banking Platform includes a powerful set of natively embedded data/AI capabilities.

- Agentic AI will allow banks to unlock productivity gains across all their critical customer servicing and sales operations.

- High priority capabilities include Conversational Banking, Customer Lifetime Orchestration, Advanced Financial Insights, and AI-Augmented Customer Support.

- The Intelligence Fabric will leverage Backbase’s Grand Central Integration Platform-as-a-Service to unify data from diverse sources in a bank’s tech ecosystem.

Financial services must innovate now and Rimini Street can help free up the capital, executive says

Rimini Street is well-known for providing enterprise support long after the vendor has abandoned its own product, or tried to force a subscription model on perpetual license holders. What you may not know is that Rimini Street can also provide cutting-edge guidance on where your financial services organisation could be investing instead of spending on costly ERP upgrades.

Backbase delivers industry leading digital banking platform to support MyState’s future growth ambitions

ANNOUNCEMENT: Backbase, the global leader in engagement banking, has successfully delivered a new digital banking platform for MyState Bank (MyState) to support future growth. The platform represents a significant leap forward in delivering seamless, customer-centric digital experiences to MyState customers.

Zeller unveils the first next-generation payments and POS solution designed and engineered in Australia

The new Zeller Terminal 2, with a built-in point-of-sale app, redefines all-in-one payments and POS for businesses by combining industry-leading design, customisation, innovation, and affordability.

Backbase delivers industry leading digital banking platform to support MyState’s future growth ambitions

COMPANY NEWS: Backbase, the global leader in engagement banking, has successfully delivered a new digital banking platform for MyState Bank (MyState) to support future growth. The platform represents a significant leap forward in delivering seamless, customer-centric digital experiences to MyState customers.

How AI is Transforming the Banking Industry

Artificial intelligence is changing the banking business, with major implications for both traditional and new banks. This shift in the banking industry from traditional, data-driven AI to sophisticated generative AI which offers unprecedented levels of efficiency and customer engagement. In the banking industry, generative AI has the potential to increase productivity by 5% and decrease worldwide spending by $300 billion, according to McKinsey's 2023 banking report.

The future of banking is not simply personalised, it's hyper-personalised

Hyper-personalisation: the AI trend accelerating customer relationships in banking

GUEST OPINION by Krishna Kumar, Business Head Australia, Newgen Software Technologies: With 98.9% of banking online or via mobile apps1, coupled with the rise in mobile wallets and digital cards, its natural AI-powered customer interactions are revolutionising the sector. And it’s happening through hyper-personalisation—an AI-driven approach that transcends generic customer segments to understand and anticipate customers' individual preferences—that will shape the industry for years to come.

Backbase Strengthens AI Capabilities with Industry Veteran Chris Shayan

COMPANY NEWS: Backbase on a mission to further adopt AI across the Engagement Banking Platform and its R&D efforts

New KnowBe4 Report Finds Security Culture Improvements in ANZ but High Risk Industries Lag

Security culture has increased year over year in ANZ, but remains behind the global average. High risk industries like Government, Banking and Healthcare score well below global average.

How banks can quickly improve conduct and risk culture

COMPANY NEWS: Swarm Dynamics, an innovative Australian regtech company, is spearheading a risk analysis transformation for banks and financial institutions as the early stage company embarks on its international expansion.

Banks in APAC are ‘losing out to new customers’ due to ‘slow digital transformation’ claims global banking services giant

A third of banks in key markets across the globe, including in the APAC region, are losing large numbers of their customer base to rivals due to slow digital transformation, globalbanking services company 10x Banking claims.

Macquarie uses Google Cloud for AI-enhanced banking

Macquarie Group's banking and financial services group has been working with Google Cloud to develop AI and ML capabilities aimed at improving the customer experience.

WEBINARS & EVENTS

- OutSystems Announces ONE 2025: The Future of AI-Powered Application and Agent Development Unveiled

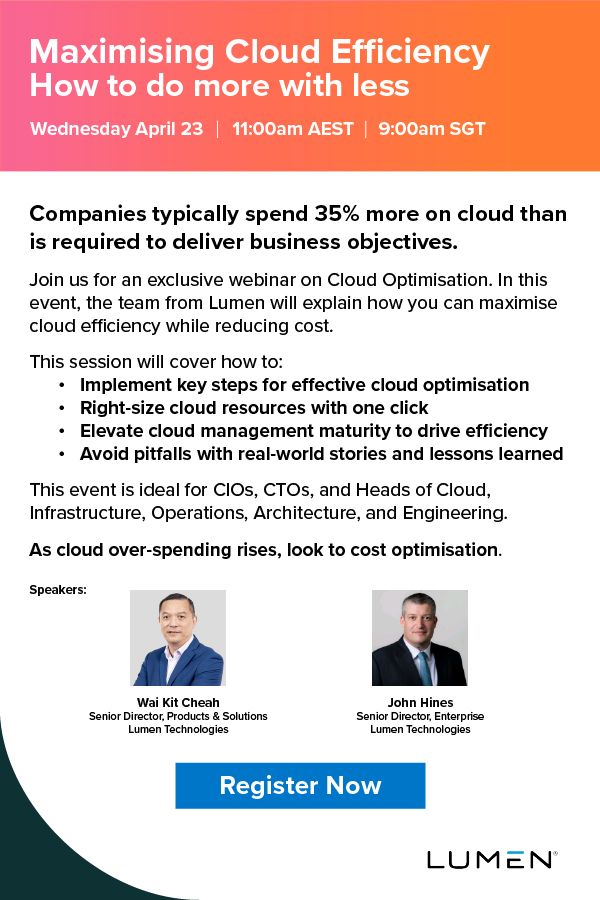

- 8 DAYS TO GO - Maximising Cloud Efficiency - How to do more with Less

- 12 DAYS TO GO - Maximising Cloud Efficiency - How to do more with Less

- UiPath to Unveil Latest Agentic Automation Solutions at Agentic AI Summit

- ALL WELCOME - 6 DAYS TO GO - AI in Action is your opportunity to gain actionable strategies for deploying scalable, reliable AI solutions that drive measurable business outcomes.

CYBERSECURITY

- Infotrust 'shines as Finalist for SOC Provider of the Year and Female Cyber Security Leader of the Year' at the 2025 Australian Cyber Awards

- Kaseya unveils Spring 2025 innovations, showcasing ‘AI-Driven innovations’ across IT management and cybersecurity

- Australians warned: 'Election scams on the rise' following U.S. Trends

- The Blue Team Burnout and How to Prevent It

- Report reveals record-breaking year for Microsoft vulnerabilities

PEOPLE MOVES

- Gerry Sillars is Bolstering Semperis’ Identity-Driven Cybersecurity Efforts in Asia Pacific and Japan

- Tenable Appoints Steve Vintz and Mark Thurmond as Co-CEOs

- Barracuda Appoints Ketan Tailor as Chief Customer Officer

- SYSPRO appoints Leanne Taylor as Chief Revenue Officer

- Cloudian appoints new APJ Channel and Marketing Directors

GUEST ARTICLES

- Logicalis expand APAC SOC services with launch of Cisco MXDR

- OutSystems Announces ONE 2025: The Future of AI-Powered Application and Agent Development Unveiled

- National 'research and development crisis' calling for Team Australia

- AI Hype Cycle meets Reality for Construction Industry

- New Book from Boomi Warns: AI Will Fail Without a Digital Infrastructure Overhaul

- Research Firm Names Datadog an AIOps Market Leader

- Why finance teams can’t afford to ignore shifting spend trends and artificial intelligence innovation

-

Why I switched from AliExpress to local suppliers for Amazon dropshipping

GUEST OPINION: My dropshipping journey with Amazon began like most…

Guest Opinion

- New Book from Boomi Warns: AI Will Fail Without a Digital Infrastructure Overhaul

- Why finance teams can’t afford to ignore shifting spend trends and artificial intelligence innovation

-

Why I switched from AliExpress to local suppliers for Amazon dropshipping

GUEST OPINION: My dropshipping journey with Amazon began like most…

-

How social media automation can boost your sales

GUEST OPINION: Social media isn’t just for brand awareness anymore.…

-

5 Secrets to Faster Innovation in IT You Can't Avoid to Ignore

GUEST OPINION: Imagine this scenario: Two competing financial institutions decide…

-

This is why great content alone won’t get you found on Google

GUEST OPINION: You just dropped what you know is a…

- Why Limiting Your Hiring to One Country Is Holding Your Business Back

- Data Management – It’s a High-Stakes Game

ITWIRETV & INTERVIEWS

- Amazon CISO CJ Moses gives rare interview

- Matt Salier explains the Australian Cyber Collaboration Centre's voluntary data classification framework

- Qualys CEO Sumedh Thakar explains the Risk Operations Centre (ROC)

- iTWire talks to SailPoint about identity management in the Enterprise

- How Blue Yonder is applying AI and innovation to solve supply chain challenges

RESEARCH & CASE STUDIES

Channel News

Comments

-

Re: iTWire - Can cyber security be a platform for innovation and growth?

Most cybersecurity is making up for weak platforms. We need to address the fundamentals, design platforms that prevent out-of-bounds access[…]

-

Re: iTWire - Why Software Developers Need a Security ‘Rewards Program’

For most developers the security/performance trade off is still the hardest one to tackle, even as the cost of processing[…]

-

Re: iTWire - The Risc-V architecture that can shape the future of computing

RISC has been overhyped. While it is an interesting low-level processor architecture, what the world needs is high-level system architectures,[…]

-

Re: iTWire - Is Linux finally ready to storm the mainstream?

There are two flaws that are widespread in the industry here. The first is that any platform or language should[…]

-

Re: iTWire - Transport for NSW and HCLTech expand digital transformation partnership

Ajai Chowdhry, one of the founders and CEO of HCL is married to a cousin of a cousin of mine.[…]