During the third quarter of 2018, the company recorded losses of $937 million, compared to a loss of $1.04 billion in the corresponding quarter a year ago.

But the company's presentation of the results, by chief executive Bill Morrow (seen above) and chief financial officer Stephen Rue, made no mention of the red ink on the balance sheet.

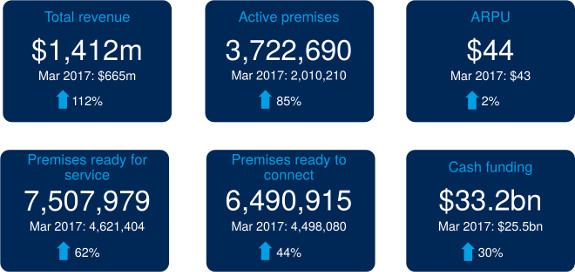

Instead the pair focused on the metrics that had an upside:

- the rise of revenue for the quarter to $1.4 billion ($665 million in Q3 2017);

- active premises of 3.7 million, a rise of 85% from March 2017;

- average revenue per user which rose by a dollar to $44 from March 2017;

- premises ready for service which was 7.5 million, up from 4.6 million in March 2017 (62% up);

- premises ready to connect (6.49 million, up 44% from March 2017); and

- cash funding which rose by 30% to $33.2 billion.

|

|

“We’ve shown stable performance against our long-term goals on the build side and significant improvements on customer experience.

“Our monthly progress report demonstrates that our customer experience program is working, and we know there’s more to do to get this right. The NBN Co team, delivery partners and RSPs are working quickly to make improvements across the industry for a better experience for all.”

Morrow has quit the company and is due to make his exit by the end of the year.

Update: An NBN Co spokesperson claimed Rue had mentioned the company's losses during the presentation.

He was quoted as saying: "We have again provided a summary of our financial statement for the nine-month end of 31 March 2018. And again, I would like to highlight the adjusted EBITDA metric, which excludes subscriber cost. These losses continue to reduce with a loss for the nine months of $138 million and a loss for the three months to 31 March of $7 million."

Graphic: courtesy NBN Co