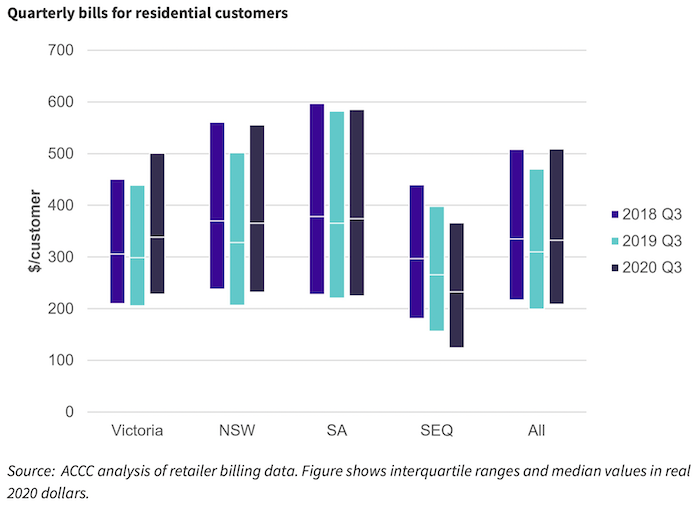

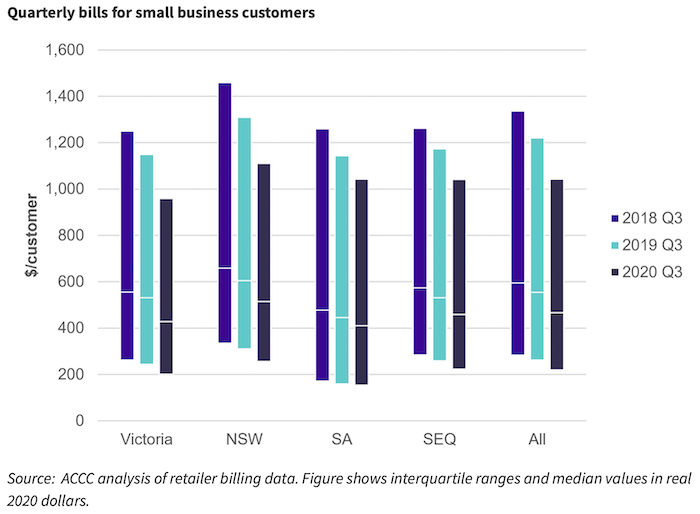

The ACCC’s latest electricity markets report, released on Thursday, shows that COVID-19 restrictions had significant impacts on electricity bills, with households using 10% more electricity as people spent more time at home, and small businesses using 17% less due to reduced onsite business activity.

“COVID-19 had a major effect on electricity use last year. Many households that were already experiencing financial difficulty had higher electricity bills to pay, and although lower bills for small businesses would normally be something to celebrate, it wasn’t a welcome outcome in the context of a pandemic recession,” ACCC Chair Rod Sims said.

The ACCC notes that while the pandemic changed electricity consumption patterns in 2020, average wholesale spot prices - which are the prices that retailers pay day-to-day for uncontracted electricity - fell by 50% between mid-2019 and early 2021.

|

|

This has been partially offset by higher spot prices in May and June, due to several factors including a major generator outage in Queensland.

Overall, however, the ACCC expects retailers’ wholesale costs to remain low relative to recent years.

Sims said the ACCC is looking to see if electricity retailers have lowered their prices in line with these wholesale price reductions, so households and small businesses see the benefit.

“We expect 2021 to be a better year for households and small businesses as large reductions in the wholesale cost of electricity continue to flow through to people’s bills,” Sims said.

The Prohibiting Energy Market Misconduct (PEMM) law that came into effect in June 2020 requires electricity retailers to make reasonable adjustments to their prices in line with their costs of procuring electricity.

ACCC analysis in March this year revealed that if all customers in eastern and southern National Electricity Market states were to switch to the cheaper deals that are available, or benefit from retailers lowering the prices of their existing plans, the annual savings would be about $900 million compared to June 2020.

“The ACCC is currently investigating a number of electricity retailers’ prices to see if recent wholesale price reductions are being passed on to consumers, as required by law,” Sims said.

The report shows that seven per cent of residential customers were still on more expensive standing offers in 2020, but more and more households have shifted to cheaper market offers in recent years.

The median price under a residential standing offer was 18% more expensive than the market offer. A typical household still on a standing offer could save almost $200 per year by switching to a median market offer.

The proportion of small business customers on standing offers in 2020 was 16 per cent, which is more than double the residential proportion, and this percentage has not dropped over the last three years.

The ACCC notes that for a typical small business customer, the median standing offer was 35% more expensive and the annual saving from switching to a median market offer was almost $350.

"We are concerned about the high number of small businesses that are still on more expensive standing offers,” Sims said.

“Standing offers were originally intended to be a safety net for customers to get a basic service at a reasonable price, but over time they became some of the highest-priced plans. Reforms were introduced to cap standing offers and protect customers from very high prices, but people can still save more on a market offer.

“Many small business owners on standing offers wouldn’t be aware what plan they’re currently on, so the best way to get cheaper electricity is to visit the Energy Made Easy website and compare offers.”

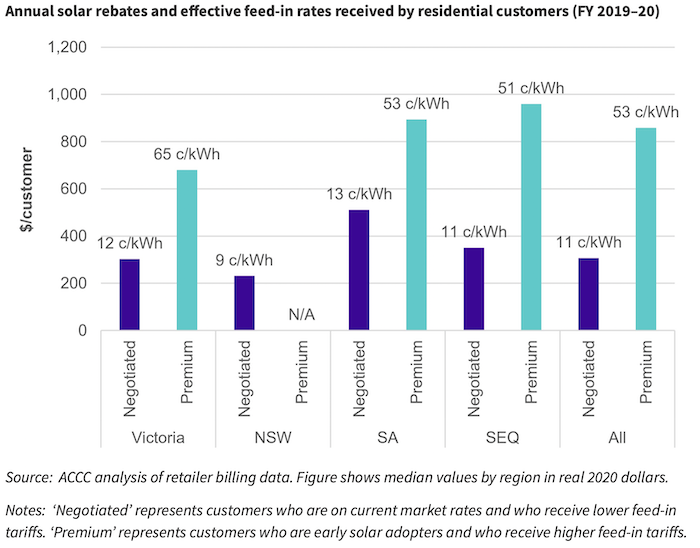

The report also reveals the contrast in electricity costs for solar and non-solar customers.

In 2020, prices paid by solar residential customers were 29% lower than those paid by non-solar residential customers, after accounting for any feed-in tariffs. The average household with solar paid $94 less on their quarterly bill, despite using more energy from the grid.

And prices paid by solar small business customers were 31% less than non-solar small businesses.

Solar customers on premium feed-in tariffs, which are the legacy subsidised rates that were set at much higher levels, had median annual rebates of $858 for residential and $1993 for small business.

“Solar installation in homes and small businesses has been one of the biggest changes in the electricity sector over the last decade,” Sims said.

“The early solar adopters who are receiving premium feed-in tariffs are getting great deals, but we remain concerned that these rates are being subsidised by non-solar customers.

“Customers on hardship or payment plans have the lowest rates of solar, so you have to question how fair it is for these people to be subsiding the costs of solar customers,” Sims concluded.

The report is available on the ACCC’s website at Electricity market monitoring 2018-2025.