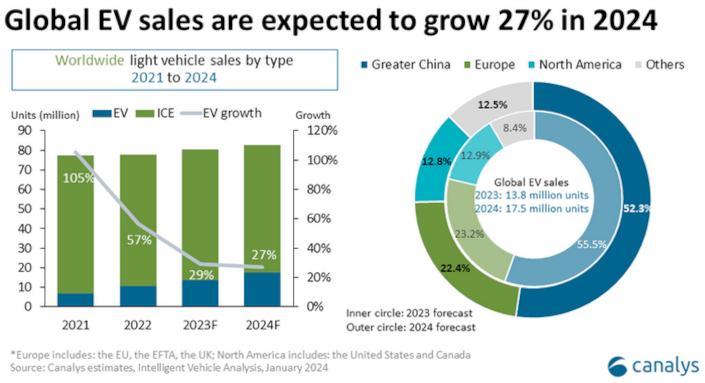

The company said Greater China was the biggest EV market, shipping 7.6 million cars or 55.5% market share. Europe (3.2 million units) and North America (1.8 million cars) rounded off the top three markets in 2023.

Canalys analyst Alvin Liu said a number of appealing new EVs had been launched at the end of 2023, setting the stage for sales growth in 2024.

“EVs are the core growth driver for the vehicle market in Greater China. EVs from Chinese carmakers, which are expected to take up 78% of the market in 2024, are pulling ahead, widening the user experience gap compared to internal combustion engine vehicles," he explained.

|

|

"However, maintaining a growth rate of over 50% this year is impossible as EVs have reached a critical mass and convincing the remaining EV sceptics will be a growing challenge.”

Canalys forecast that the 2024 European light vehicle market would sustain growth of 2% to 3%, with EVs taking up 24.2% of market share, shipping 3.9 million units.

It said slowing demand for battery electric vehicles would lead to a shift to plug-in hybrid electric vehicles which could ease market pressures, despite the EU’s push for an aggressive combustion engine phase-out.

“Europe’s EV market has started transitioning from policy-driven to product-driven in 2024, a necessary phase in the industry’s transformation,” said Canalys principal analyst Jason Low.

“The subsidy restriction will slow down EV demand and the looming price war will threaten not just EV goals but carmakers’ electric transition confidence.

"To counter such challenges, carmakers in Europe are set to make the EV market more affordable by releasing new models such as the KIA Niro EV, BMW IX2, Renault 5, Citroen e-C3 and others.

"European carmakers should be aware of Chinese carmakers eyeing Europe, as they are expected to deploy similar product and pricing strategies while continuing their efforts to establish local production in the region, like that of BYD, SAIC and other positive OEMs.”