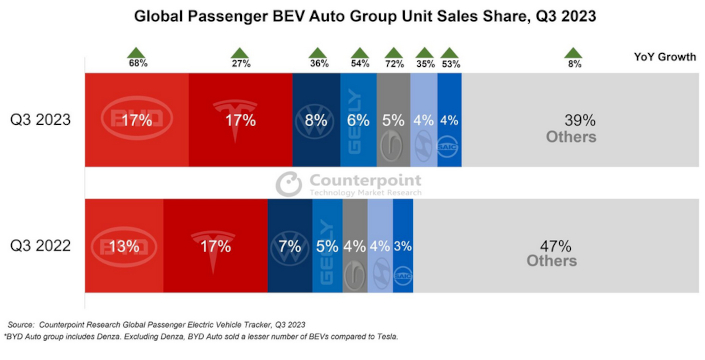

Though China remained the top-selling country, it struggled to maintain its position due to a weak economy and price competition, with sales only growing by 11%, well below the global average.

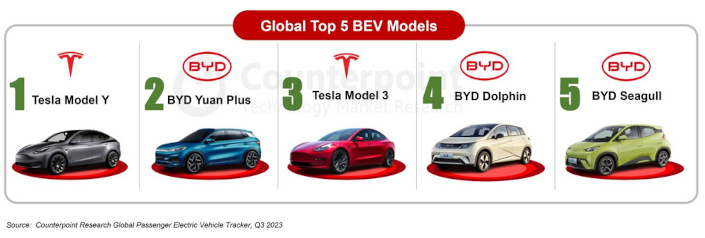

But BEVs made in China — Tesla, BYD and Volkswagen — were the biggest sellers, with BYD equalling Tesla and expected to overtake in in the final quarter of the year.

Counterpoint senior analyst Soumen Mandal said: “China still holds 58% of the global BEV market, with the US taking around 12%. Germany, the third-biggest BEV market, also grew more than 60% annually.

|

|

"But despite the US BEV sales growing by 63% year-on-year in 3Q, several automakers are cutting back on EV-related expenses as customers are unwilling to pay extra for BEVs over internal combustion engine vehicles and hybrid alternatives.

"Ford has decided to postpone its US$12-billion investment for EVs. Similarly, GM has decided to de-accelerate its EV production and delay the launch of new EV models. GM has also scrapped the plan to manufacture affordable EVs (below US$30,000) with Honda.”

Counterpoint research director Jeff Fieldhack said annual BEV sales were expected to reach almost 10 million in 2023.

"Despite falling below automakers’ expectations, BEV sales in the US are projected to surpass 50% year-on-year growth," he said. "The decreasing cost of lithium-ion batteries together with the development of low-cost alternative battery chemistries will help the affordability of BEVs.

"Both Europe and the US are expected to maintain substantial investments in securing access to essential minerals for BEVs, thereby reducing dependence on China.

"To counter China’s influence in Western auto markets, the European Union has launched an anti-subsidy probe on China-made BEVs. The influx of low-cost BEVs from China has been adversely affecting Europe’s domestic automakers.

"This underlines the growing competitiveness in the BEV market, which is expected to intensify further.”