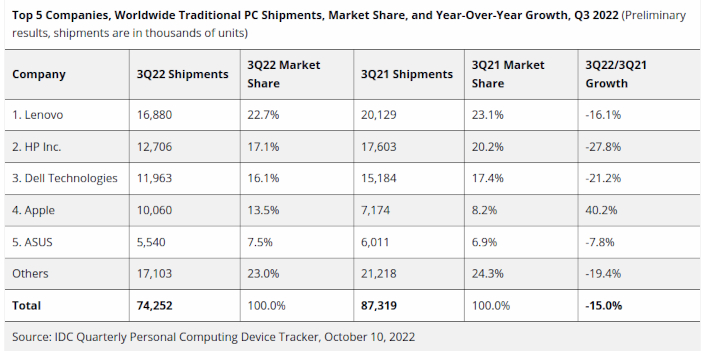

Another analyst firm, IDC, put the drop at 15%, adding that shipment volumes were above pre-pandemic levels when the drivers were commercial refreshes due to the looming end of support for Windows 7. IDC counts traditional PCs, which include desktops, notebooks, and workstations and do not include tablets or x86 Servers.

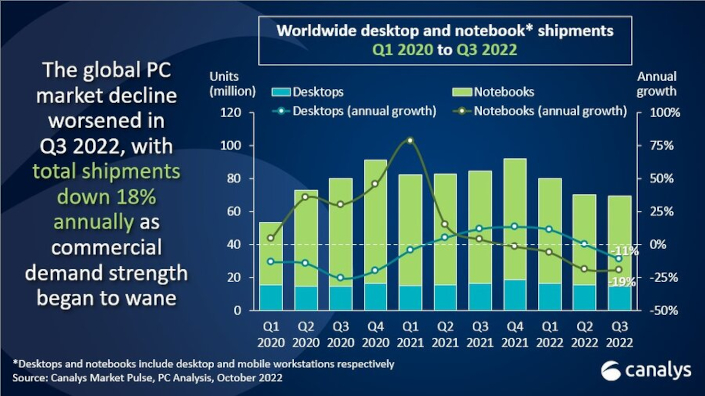

Canalys said in a statement notebook shipments were the worst hit, with 54.7 million units shipped, a year-on-year decline of 19%.

Desktop shipments, being less reliant on consumer spending, fell 11% year-on-year, with 14.7 million units being shipped.

|

|

"Supply has also reacted to the new lows by reducing orders, with Apple being the only exception as their third quarter supply increased to make up for lost orders stemming from the lockdowns in China during the second quarter.

Canalys senior analyst Ishan Dutt said following a slowdown in the first half of the year, the PC market had now posted a record year-on-year decline.

“While the Q3 shipment volume remains comparable to pre-pandemic figures, the rapid deterioration in demand across all segments is a worrying sign not only for vendors, but for stakeholders across the supply chain," he said.

"Intel and AMD are facing headwinds from weakness in their PC businesses, and smaller makers of components from ICs to memory are cutting production and lowering earnings forecasts.

"Although promotional activities by retailers have helped clear some inventories ahead of the holiday season, overall enthusiasm for PCs among consumers has dwindled in the face of rising costs across other goods and services.

"Education deployments, which were an important new source of PC growth in 2021, have also been reduced as public sector funding is directed towards more immediate needs and schools in most developed markets are at an adequate ratio of devices to students with in-person learning largely resumed.”

Linn Huang, research vice-president, Devices & Displays at IDC, said the company would be monitoring both shipment volumes and also how average selling prices (ASPs) trended during the final quarter of 2022.

"Shortages over the last several years have aggressively driven product mix shifts towards the premium end. This, coupled with cost increases of components and logistics, drove ASPs up five quarters in a row to $910 in 1Q22, the highest since 2004," he said.

"However, with demand slowing, promotions in full swing, and orders being cut, the ASP climb was reversed in 2Q22. Another quarter of ASP declines indicates a market in retreat."

Dutt said it was alarming that vendors, channel partners and other industry players had begun indicating in Q3 that commercial procurement, which had remained strong in the face of worsening economic conditions, had come under threat as IT budgets were being reprioritised or slashed.

“Businesses are exhibiting greater caution by extending device refresh cycles as they weather the current uncertainty," he noted. "A positive signal for the PC market had been the relatively robust employment and hiring numbers in major markets.

"However, indications that this could reverse will further diminish commercial demand as the need for new PCs drops off. Business investment also faces constraints as the cost of borrowing is set to continue rising with interest rate hikes planned throughout the next few quarters.

"Despite the current adverse environment, the importance of PCs to support new workstyles and digital transformation goals remains high. Older devices in the installed base will need to be replaced and the market is expected to see recovery by the second half of 2023.”

Canalys said Lenovo had kept its number one position but suffered a 16% year-on-year drop to 16.9 million units, while HP underwent the largest decline of the top five for the second successive quarter as it shipped 12.7 million units, a 28% year-on-year fall.

The firm said these were the lowest shipments totals since the onset of the pandemic in 1Q 2020 for both Lenovo and HP.

Dell, which was third, also posted a significant decline of 21% in shipments, with just under 12 million units shipped.

Apple, however, enjoyed a better quarter as it filled orders from 2Q, which had been delayed due to supply disruptions in China, and launched new M2 Macbooks. It sealed fourth place with 8.0 million units, a modest year-on-year increase of 2%. Asus rounded out the top five with 5.5 million units, an annual decrease of 8%.

Update, 13 October: Technology analyst firm Gartner has put the slip in shipments at 19.5% year-on-year, coming in at 68 million units.

In a statement, the company said was the steepest market decline since it had begun tracking the PC market in the mid-1990s and the fourth consecutive quarter of year-on-year decline.

“This quarter’s results could mark a historic slowdown for the PC market,” said Mikako Kitagawa, director analyst at Gartner.

“While supply chain disruptions have finally eased, high inventory has now become a major issue given weak PC demand in both the consumer and business markets.

"Back-to-school sales ended with disappointing results despite massive promotions and price drops, due to a lack of need as many consumers had purchased new PCs in the last two years.

"On the business side, geopolitical and economic uncertainties led to more selective IT spending, and PCs were not at the top of the priority list.”