Global small business platform Xero has released new research that "reveals that nearly one in five Australian small businesses are processing payroll without using any software as the implementation of Single Touch Payroll gets underway".

So, what is STP?

We're told that it's "a new way of reporting tax and super information to the ATO in real-time from an employer’s payroll software each pay day. The law change is now compulsory for employers with 20 or more employees, and is expected to be extended to all employers from 1 July 2019".

|

|

"Our own Xero data shows that businesses leveraging digital the most are seeing significant benefits with increased revenue and employment growth.”

“The ATO’s introduction of STP is a huge step to help reduce the compliance burden on small businesses. I’m excited that this will be boosted by more businesses using dedicated payroll solutions, which will help save them even more time so they can focus on what matters – running their small business.”

“However, we need to be supporting these businesses, many of whom are transitioning from outdated spreadsheets, paper based systems, or even faxing this crucial data.”

Xero said its research "reaffirms that many small business owners will be moving from a paper or spreadsheet solution to a payroll provider or platform, increasing the potential stress of this transition".

Innes continued: “The numbers show that 37% of small business owners haven’t thought of moving to a digital payroll program to prepare for STP. These individuals are facing a significant change as they move to a system they’re familiar with, that might be a spreadsheet or a paper based system, to a new platform".

Room to automate and digitise

Xero said its research "also highlights how many Australian small businesses still take a manual approach to backend accounting and payroll processes. One in three employers provide payment summaries (previously called group certificates) to their employees via mail or fax".

According to Innes, this reinforces how much room there is for Australian small businesses to embrace automation and digitisation.

“As a nation, it’s important that we help small business owners understand that digitising and automating their backend processes can provide a huge competitive advantage. Of course it saves time, but most importantly it frees up the head space needed to move beyond administering a business and start developing it,” he continued.

Meanwhile, we're told that "54% of small business owners said they would prefer to outsource or automate their payroll and tax processes – more than HR and recruitment, sales and marketing, and IT management combined.

"This isn’t surprising considering more than one in four (28%) spend over two hours a week on payroll, with 8% spending over five hours weekly just on payroll documentation and processing.

“Doing business today means there’s so much more that technology can do to take the pain points out of running a business so that owners can concentrate on what they’re most passionate about,” Innes concluded.

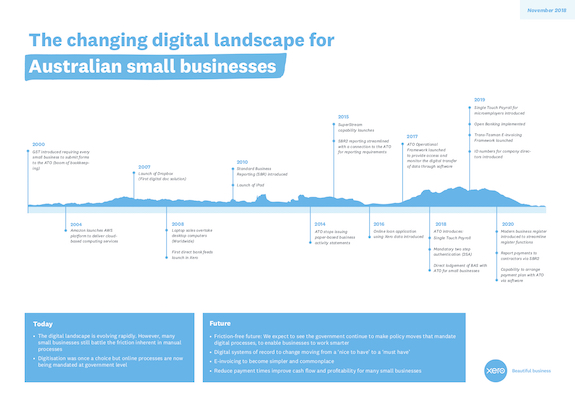

The image below can be downloaded as a full resolution one-page PDF here, or by clicking the image below.