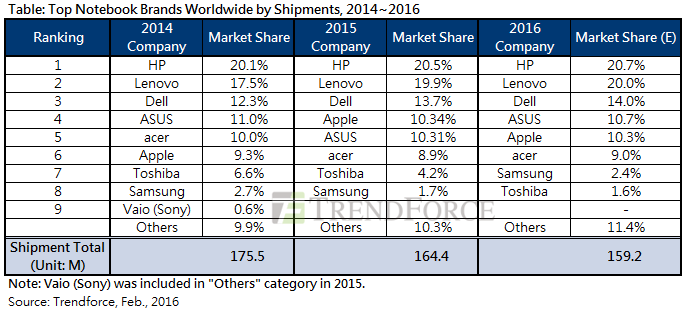

According to the global market research firm TrendForce, worldwide notebook shipments (that is any clamshell-style regardless of operating system) totalled 164.4 million units, representing a year-on-year decline of 6.3%.

The release of Windows 10 in the Q3 and Intel’s 6th generation Skylake CPU in Q4 also delayed notebook purchases to 2016.

“HP and Lenovo will again compete for the top spot in 2016,” said TrendForce notebook analyst Anita Wang. “HP has a good chance of holding the most market share this year and maintaining its leadership position because of the relatively stronger U.S. market. Dell will likely retain third place in the notebook shipment ranking for this year. As for ASUS, Apple and Acer, their struggle for the fourth, fifth and sixth positions in the 2016 ranking will be fierce since they have similar market shares of just around 10%.”

South Korea’s Samsung (eighth place) will try to revitalize its notebook business already announcing support for Windows 10. New entrants such as Xiaomi and Huawei will also roll out notebook products however shipments will be limited this year because they will be just testing the market.

|

|

HP’s notebook sales were driven by strong U.S. demand from the beginning of Q2, 2015 though its shipments were smaller less than 2014. It kept its first place ranking with a 20.5% market share.

Lenovo’s 2015 notebook shipments grew 6.9% annually with a market share of 19.9%. Despite the demand in Europe being generally weak, Lenovo continued to develop its sales channels there. By expanding its market share in Europe, the Chinese brand increased its overall notebook shipments.

Dell retained third place in the 2015 ranking due to robust sales of its Chromebook in North America. The brand saw its notebook shipments grew 4.3% annually and took 13.7% of the global market.

Apple managed to overtake ASUS and Acer to become the number four brand. New MacBook models and strong demand in the US drove Apple’s notebook shipments, bringing its global market share to 10.34%.

ASUS focused its sales efforts on notebook during last year’s final quarter, resulting in a massive quarterly shipment growth of over 70%. ASUS accounted for 10.31% and fell to the fifth place in the ranking.

Acer’s notebook business faced challenges in different regions during 2015. The Taiwanese brand lost market share to Lenovo in Europe, and its Chromebook sales in the U.S. were impacted by tough competition from HP and Dell. Consequently, Acer’s 2015 notebook shipments fell considerably by 16.6% from the prior year. It was sixth in the annual ranking or 8.9% of the global market.