The Telsyte Australian Subscription Entertainment Study 2022 found entertainment subscription services have become essential to Australians’ content consumption and discovery across video, games and music.

Services and higher demand for “at home” entertainment and services increased by more than six million to 48.4 million during the twelve months to June 2022.

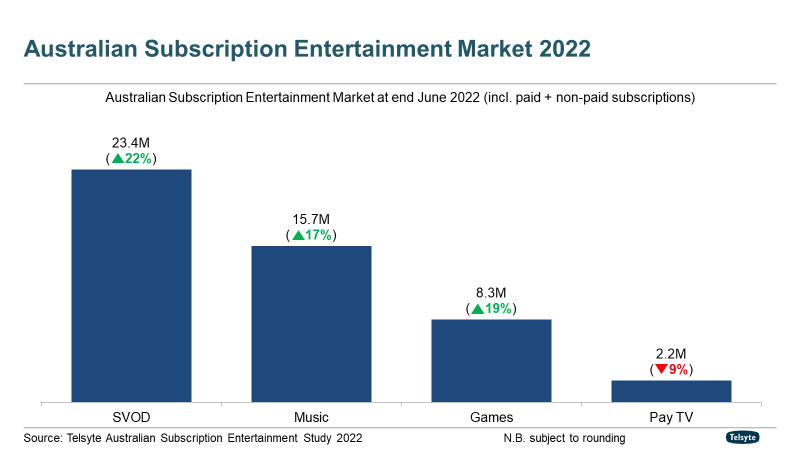

SVOD, streaming music and games-related subscription services all experienced growth during the measured period (22%, 17% and 19%, respectively) while traditional pay TV continued with a 9% year-on-year decline.

|

|

Telsyte’s research found streaming entertainment is now considered “essential” for more than half (54% for SVOD and 52% for music) of users.

Despite macroeconomic headwinds and “cost of living” pressures, Telsyte continues to forecast growth for all sectors, with games growing the fastest to 2026.

SVOD services remain remarkably sticky, despite growing headwinds

Australian Subscription Video on Demand (SVOD) services reached 23.4 million at the end of June 2022, an increase of 22% from 19.2 million in June 2021.

More than 70% of Australian households now have at least one SVOD service, up from 62% a year ago. The number grew to 77% among households on nbn.

Telsyte forecasts SVOD subscriptions could exceed 30 million by June 2026 driven by a content boom, growth in consumers having multiple subscriptions, new market entrants, and the introduction of ad-supported plans.

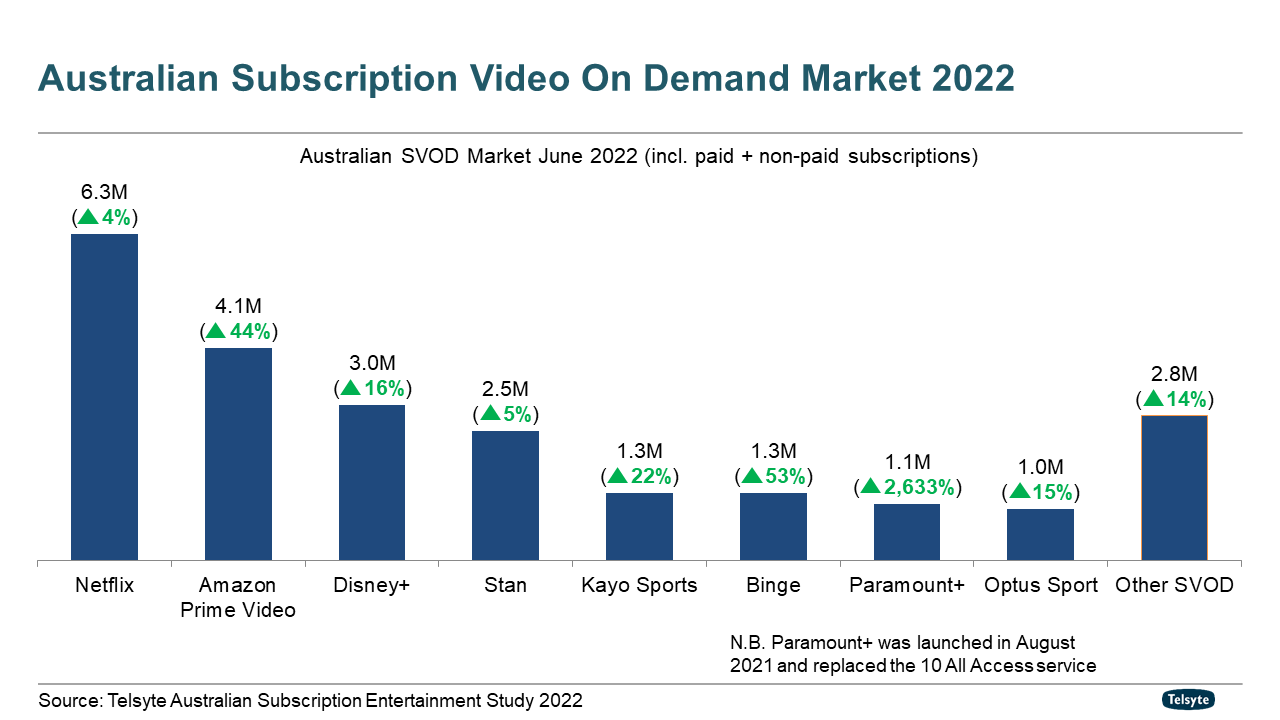

The study found Netflix (6.3 million) remained the top SVOD provider at the end of June 22, followed by Amazon Prime Video (4.1 million), Disney+ (3 million), Stan (2.5 million), Kayo Sports (1.3 million), Binge (1.3 million), Paramount+ (1.1 million), and Optus Sport (1 million).

SVOD market revenue was estimated at $2.7 billion for FY2022—an annual increase of 27%.

While there is a seasonal demand for SVOD content, Telsyte believes the top service providers’ revenue will continue to grow annually due to price rises, and new ad-supported plans.

The proliferation of SVOD services and new content partnership deals continue to fuel multi-subscriptions and the average number of SVOD subscriptions per subscriber climbed to 3.3 in June 2022 (up from 3.1 in June 2021).

More than one in three (37%) of the subscribing households have three or more services.

As the cost of living soars, 40% of SVOD users are expecting a price increase in streaming video services this year. Forty-four percent of subscribers also plan to review their entertainment spending.

A third (32%) of SVOD users say they regularly “review and manage their subscriptions” (drop in and out).

However, more than half (51%) of users indicated they continue to discover interesting new content through the services they subscribe to.

“The power of recommendations and creating stickiness with algorithms cannot be underestimated when looking at any format of video content—long or short,” Telsyte managing director Foad Fadaghi says.

But some underlying risks remain. Around one in three (36%) of SVOD users are more likely to switch between different services to save money. The figure rises to 46% among those who regularly ‘manage’ their subscriptions.

While the study found one in four Australians (26%) have cancelled at least one service and not re-subscribed during the measured 12 months, the top 10 SVOD services have all continued to see increased adoption.

Around one in three (35%) of SVOD users are interested in more affordable ad-supported service plans. One in four (23%) non-users are interested inj using ad-supported SVOD services.

Telsyte estimates ad-supported plans could lift the average number of subscriptions per household closer to four (currently 3.3) by 2026.

Crackdown on account sharing a double-edged sword

To save money, customers can share accounts between family and friends.

Telsyte believes account sharing has been part of the “secret sauce” of building customer stickiness and large scale viewership for programming.

Telsyte’s study found that one in three (34%) SVOD subscribers share the services with others, and more than 50% share with people who reside in different households.

Netflix is most likely to engage in a crackdown on account sharing via an added sharing fee, but this could backfire if the customer chooses not to be forced into paying with three in five (58%) saying they will stop sharing altogether if they are required to pay to share.

The study found 62% of non-SVOD users claim there is enough good quality video content from free sources to keep them entertained and not having to pay for any subscriptions.

Freely available Broadcasting Video On Demand services (BVOD) (including 7Plus, 9Now, 10Play, ABC iView and SBS On Demand) remained popular and most services had more than 10 million viewers during FY2022.

Video game subscriptions spearheading games-related subscription growth

The study found Australians had taken up 8.3 million games-related subscriptions at the end of June 2022 (up 19% from a year ago).

Video game subscriptions grew 56% to 4.8 million in June 2022. Microsoft’s Xbox Game Pass remains the leader in the segment.

Sony recently re-launching its revamped console subscription – PlayStation Plus, which now also includes a selection of titles in its higher-tiered plans.

The next frontier of the video game segment, Telsyte predicts, is cloud gaming, or the ability to play AAA titles without using high-end hardware.

It is beginning to take shape in Australia and Telsyte estimates around half a million gamers have adopted services such as xCloud (part of Xbox Game Pass’ Ultimate plan) and Geforce Now.

Cloud gaming remains highly sought after amongst hardcore gamers that play video games for more than three hours a day.

Telsyte estimates the total number of games-related subscriptions could grow to over 14 million by June 2026, as services become increasingly attractive with more perks, new game trials and AAA titles.

“Video game subscriptions offer incredible value to gamers and are set to rapidly change the games industry like music and video before it,” Telsyte senior analyst Alvin Lee says.

Music subscriptions maintain momentum

Music subscriptions reached 15.7 million at the end of June 2022, an increase of 17% from a year ago.

The top 3 streaming music service providers in Australia remained Spotify, Google (incl. YouTube Music and YouTube Premium), and Apple Music. However, Amazon Music is increasingly popular as more claim to be utilising it as part of their Amazon Prime subscription.

In addition to music, audiobook subscriptions are also gaining momentum with more than 1 million users in 2022.

Podcasts remain an essential part of streaming music providers’ growth strategy. Telsyte found that around one in four Australians aged 16 and over listened to podcasts in 2022 with comedy, news and politics and education being the most popular genres.