That's now reached $1.5 billion, with more than 375,000 employees being paid via Xero. Although the payroll value has gone up 50% in six months, the number of employees paid has increased by less than 7%. But that's the number of unique employees. The number actually paid during a month rose 21% from 272,000 in July 2014 to 328,000 in December.

"Payroll is usually the biggest expense for small business owners with time-consuming process," said CEO Rod Drury.

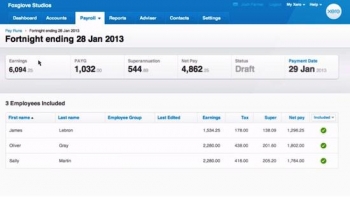

|

|

And that availability is set to increase, as Xero adds payroll functionality for its UK and New Zealand customers during the next three months.

Payroll is already available to US customers in California, Florida and Texas (the top three employer states, according to the company), and the remaining states will be supported by the end of 2015.

Xero claims its integrated payroll saves small businesses "hundreds to thousands of dollars each year" as well as giving a true real-time view of their financial position.

Drury promised "a wave of product innovations launching early this year," though he gave no clues about what they may involve, apart from stating they "will deliver on our vision of a fully integrated platform for small businesses to work and collaborate on."