The Wise platform provides cross-border payment infrastructure for banks, fintech, and enterprises, but today also helps enterprises and customers with cross-border money management needs.

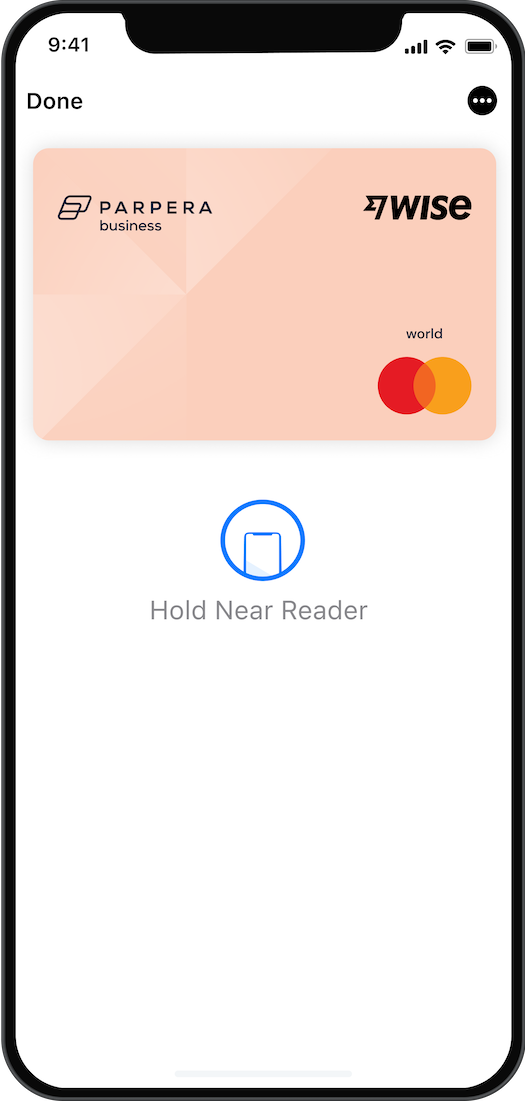

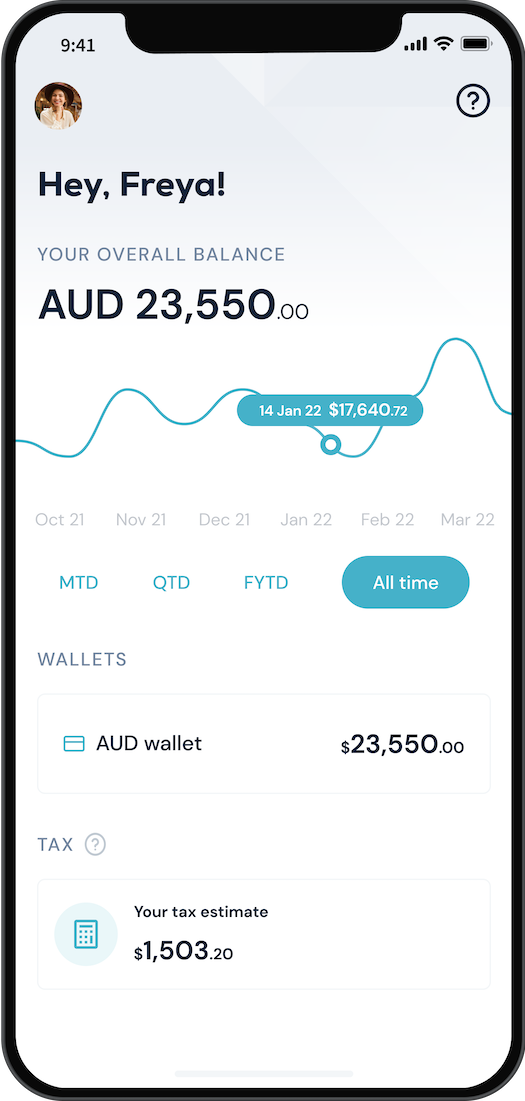

The new features are rolling out first in Australia, with two partners - ProSpend and Parpera - who will use Wise's infrastructure to issue multi-currency accounts and digital debit cards via their own interface, directly to their customers, to spend and manage money internationally with ease.

This means business owners and employers can spend like a local in more than 170 countries with one single card. The card can be Wise-co-branded or white-labelled and is a digital Visa or Mastercard debit card. All transactions use the mid-market exchange rate.

|

|

Over 40 currencies are supported, and one single multi-currency account will easily convert between them, as well as instantly general local and global account details in nine currencies including AUD, NZD, EUR, USD, GBP, and SGD.

Ultimately, this means businesses can go global with a few clicks and it becomes effortless to manage currencies from a single platform. The platform is live now with over 60 banks and non-banks in more than 18 countries. This includes Xero, Google Pay, Bank Mandiri, Deel, Monzo, Up, and others.

|

|

Wise Platform commercial lead APAC Daniel McCarthy said, "These new features are a significant step forward in our ability to support Australian-based Wise Platform partners and their customers in ways they’ve not experienced before. Traditional international banking solutions still don’t work well for businesses, and require them to use too many external tools from a range of providers to allow them to do what they need."

"The release of Wise Platform’s new features brings us one step closer to solving this pain point, enabling more businesses to expand and operate internationally, without worrying about managing complex, multi-currency cash flow."

"Compliance smarts and practices can be a huge barrier to entry to midmarket and enterprise businesses looking to expand into international payments. Leveraging Wise’s API also means they’re able to tap into Wise’s modular components, including our security and verification engines if required; Wise Platform solutions aim to enable these businesses to expand on all fronts, compliantly," McCarthy said.

ProSpend CEO Sharon Nouh said, “We are delighted to be partnering with Wise Platform as our fully integrated payment partner. The partnership aligns with our vision of delivering one hyper-automated spend platform. Combining our platform that helps businesses manage their business expenses, their account payables, and purchases with budget controls with Wise’s market-leading global payments technology, delivers this vision. By deeply integrating Wise's payments infrastructure into our platform, our customers can now run their entire company cards program from the same system they use to deliver all other services. We are excited to continue to work with Wise to innovate and improve the payment and spend management process for our mutual clients.”

Parpera CEO Daniel Cannizzaro said, “We're thrilled to partner with Wise to leverage its market-leading global payment infrastructure to enable our Australian relaunch. Initially, Wise Platform will enable us to offer Australian sole traders and small business owners access to a Business Account, Business Debit card, and payments within the Parpera App. And later, it’ll extend our offering to multi-currency wallets, and cross-border payments, unlocking greater value for businesses on our platform by enabling them to do business globally with ease. Additionally, Wise serves as a strong and trusted partner to enable Parpera’s proposition in Australia and its future expansion to new markets.”

Wise also announced its financial results, showing continued growth and strength.

Key numbers include:

- 10m active customers, 3x from 2019, and +34% YoY

- $US 946.2m income, over 5x from 2019, +73% YoY

- $US 846.1m revenue, +51% YoY

- 7th year of profitability

- APAC growth 60% YoY, contributing 19% to the Wise total