The company said in a statement that this total represented global passenger car shipments and did not include vehicles which were connected by smartphone.

Senior analyst Aman Madhok said: “The market saw a healthy growth of 18% year-on-year in the second quarter of 2020 with connected car shipments reaching close to seven million units during the period. The penetration of connectivity in cars continues to increase, and 2020 will see half of all cars sold worldwide having embedded connectivity in them.

“While the market witnessed year-on-year growth, shipments declined by 5% when compared to 1Q 2020 due to the subdued passenger car sales following the COVID-19 pandemic, even though rebounding car sales in China helped in market recovery to some extent.”

|

|

"5G connected cars will enter mass production next year," he said. "By 2025, one out of every five connected cars will have 5G embedded connectivity. China and the US will together account for the majority of 5G connected cars sold in the next five years.”

"5G connected cars will enter mass production next year," he said. "By 2025, one out of every five connected cars will have 5G embedded connectivity. China and the US will together account for the majority of 5G connected cars sold in the next five years.”

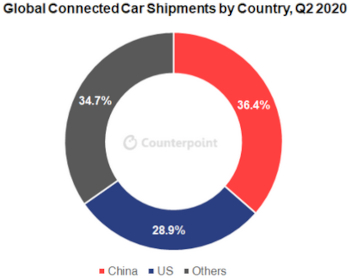

Regarding market trends, research director Peter Richardson said: "While the E-call regulation has been driving connected car shipments in Europe, increasing cockpit digitisation, coupled with customer preference for connected services, is driving the growth in the US and China.

"Both countries together accounted for close to two-thirds of connected car shipments in 2Q 2020. Automakers, too, are promoting connected services to attract buyers and earn additional revenue through subscriptions.”

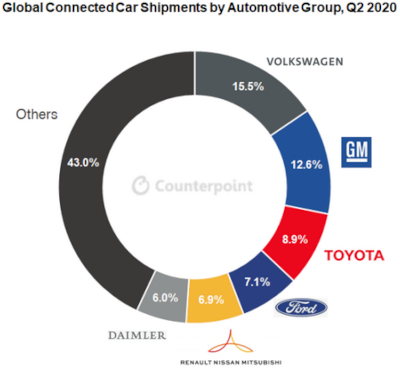

Richardson added that mainstream brands had now begun to take connectivity seriously. "A few years back, luxury cars like Mercedes-Benz and BMW accounted for most of the embedded-connectivity cars sold, along with some mainstream brands like GM," he said.

Richardson added that mainstream brands had now begun to take connectivity seriously. "A few years back, luxury cars like Mercedes-Benz and BMW accounted for most of the embedded-connectivity cars sold, along with some mainstream brands like GM," he said.

"But now more mainstream brands, like Volkswagen and Toyota, have started to take connectivity seriously, giving a huge push to connected car shipments.”